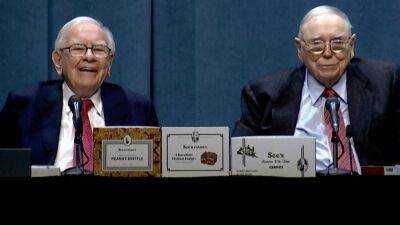

Warren Buffett says American banks could face more turbulence ahead, but deposits are safe

In this article

Berkshire Hathaway CEO Warren Buffett on Saturday assailed regulators, politicians and the media for confusing the public about the safety of U.S. banks and said that conditions could worsen from here.

Buffett, when asked about the recent tumult that led to the collapse of three mid-sized institutions since March, launched into a lengthy diatribe about the matter.

«The situation in banking is very similar to what it's always been in banking, which is that fear is contagious,» Buffett said. «Historically, sometimes the fear was justified, sometimes it wasn't.»

Berkshire Hathaway has owned banks from early on in Buffett's nearly six-decade history at the company, and he's stepped up to inject confidence and capital into the industry on several occasions. In the early 1990s, Buffett served as CEO of Salomon Brothers, helping rehabilitate the Wall Street firm's tattered reputation. More recently, he injected $5 billion into Goldman Sachs in 2008 and another $5 billion in Bank of America in 2011, helping stabilize both of those firms.

He remains ready, with his company's formidable cash pile, to act again if the situation calls for it, Buffett said during his annual shareholders' meeting.

«We want to be there if the banking system temporarily gets stalled in some way,» he said. «It shouldn't, I don't think it will, but it could.»

The core problem, as Buffett sees it, is that the public doesn't understand that their bank deposits are safe, even those that are uninsured. The Berkshire CEO has said regulators and Congress would never allow depositors to lose a single dollar in a U.S. bank, even if they haven't made that guarantee explicit.

The fear of regular Americans that they could lose their savings, combined

Read more on cnbc.com