The most important thing Warren Buffett said Saturday, and it isn't good news for the economy

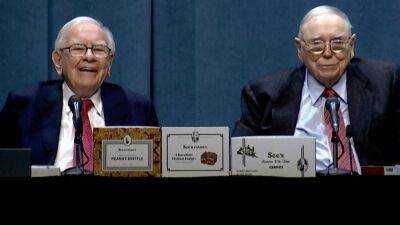

OMAHA, Neb. — Warren Buffett, whose conglomerate is viewed as a barometer for U.S. economic health because of the range of businesses it owns, said something that doesn't bode well for those believing we will skirt a recession.

The «Oracle of Omaha» believes that the «extraordinary period» of excessive spending on the back of pandemic stimulus is over, and now many of his businesses are faced with an inventory build-up that they'll need to get rid of by having sales, he told about 40,000 shareholders who gathered in Omaha at Berkshire Hathaway's annual meeting Saturday.

«It is a different climate than it was six months ago. And a number of our managers were surprised,» Buffett said Saturday. «Some of them had too much inventory on order, and then all of a sudden it got delivered, and people weren't in the same frame of mind as earlier. Now we will start having sales when we didn't need to have sales before.»

Berkshire owns a diverse group of subsidiaries, from Borsheims Fine Jewelry and sportswear Brooks Running, to Duracell, See's Candies, DQ, apparel company Fruit of the Loom, as well as Nebraska Furniture Mart. Investors always look to Buffett for economic insights as his myriad of businesses are closely tied to broader spending and overall demand. Then there's his ownership of BNSF Railway, which gives him a broad view of goods being shipped around the country, and his significant energy operations, which can also give clues to the level of economic activity.

Buffett said his businesses had experienced an «extreme» period where consumers splurged, which led to many managers at his subsidiaries overestimating demand for certain products.

«It was just a question of getting goods to deliver. People bought, and they

Read more on cnbc.com