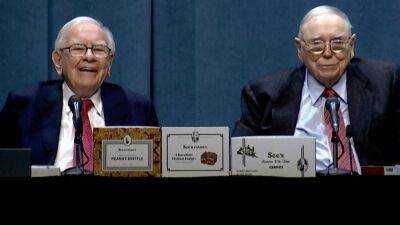

US banking crisis: Warren Buffett says bosses should face ‘punishment’

The billionaire investor Warren Buffett has said executives who led the US banking system into crisis should face “punishment”, as the American economy grapples with the worst series of bank failures since the 2008 financial crash.

The owner of the investment firm Berkshire Hathaway said US bank directors “should suffer” when they run into trouble, adding that he was wary of most banking stocks because of “the messed-up incentives”.

The comments made by Buffett, 92, who is known to investors as the “Oracle of Omaha”, come a week after the collapse of First Republic Bank, the biggest US bank to fail since the 2008 financial crisis.

Speaking at Berkshire’s annual shareholder meeting, Buffett criticised how politicians, regulators and the press had handled the recent failures of Silicon Valley Bank, Signature Bank and First Republic Bank, saying their “very poor” messaging has unnecessarily frightened depositors.

He said “the CEO and directors should suffer” when the banks they run get into trouble. Otherwise, it “teaches the lesson that if you run a bank and screw it up, you’re still a rich guy, the world still goes on … That is not a good lesson to teach the people who are holding the behaviour of the economy in their hands.”

Buffett said he was still cautious about holding bank stocks and had recently reduced his exposure to the sector – with the exception of Bank of America, which he liked.

He said: “The incentives in bank regulation are so messed up and so many people have an interest in having them messed up … it’s totally crazy.” You have to have a punishment for people who do the wrong thing.

“If you look at First Republic, you can see that they were offering non-government guaranteed mortgages at fixed rates for jumbo

Read more on theguardian.com