David Einhorn to speak as the priciest market in decades gets even pricier postelection

In this article

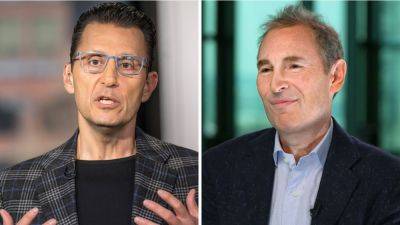

Hedge fund investor David Einhorn's cautious stance all year made his performance suffer as he navigated what he believes is the priciest stock market of his career at Greenlight Capital.

Einhorn's hedge fund returned just 9% in 2024 through the end of the third quarter, net of fees and expenses. That compares with the S&P 500′s more than 20% gain during the same period.

The high-profile investor said he's neither calling the market a bubble nor being outright bearish, but sky-high prices caused him to be conservatively positioned.

«The market isn't just making all-time highs. It is, by many measures, the most expensive stock market that we have seen since the founding of Greenlight,» Einhorn said in the latest investor letter last month. Einhorn founded Greenlight in 1996.

Einhorn is speaking at CNBC's Delivering Alpha Investor Summit on Wednesday in New York City. It will be the first chance for investors to hear from Einhorn postelection and whether his views on equity valuations and inflation have changed with the Trump and Republican policies on the way.

After a buyers' strike at the end of 2023, Einhorn came back in the market hunting opportunities, acquiring medium-sized positions in names like software firm Alight and drugmaker Viatris. Investors will be interested to hear if he's still finding any values.

Last month, he made a bullish case for Peloton, saying the shares are significantly undervalued.

These new stock picks didn't necessarily create a ton of alpha, however. Greenlight was hurt this year by its low net exposure to the market and a lack of investments in the red-hot Magnificent 7 names.

«We are likely to continue to underperform a rising market, as we have all year, but we don't

Read more on cnbc.com