Curve DAO Price Prediction as CRV Rockets Up 40% in 24 Hours – Here’s Where It’s Headed Next

The price of Curve DAO (CRV) has risen by 46% in the past 24 hours, as a whale's plot to sell the altcoin short backfired and resulted in a squeeze. CRV is currently up by 5% in a week and down by 31% in a month, with the short seller having undermined its price for over a week before its recovery in the past day.

The seller in question appears to be Avraham Eisenberg, the same individual responsible for October's Mango Markets short-selling attack. However, there's now speculation as to whether Eisenberg's main aim was to short CRV or attack Aave, which seemingly lacks the liquidity to cover the CRV short positions he'd opened.

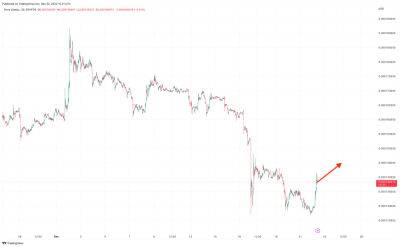

Looking at CRV's chart, its relative strength index (purple) has shot up in the last few hours, indicating strongly rising momentum. However, its 30-day moving average (red) remains below its 200-day average (blue), and currently shows no signs of rising.

However, with both indicators remaining low, this could signal an incoming rally, which is further supported by the sudden jump in the past day.

CRV's rally of the past day is largely compensation for falls over the past week or so. Back on November 10, the CRV price was roughly $0.713, yet it fell as low as $0.407171 yesterday, following the opening of a hefty short position by Avraham Eisenberg (aka ponzishorter.eth).

The simplest interpretation of CRV's price action is that its community has begun buying the altcoin in an attempt to create a short squeeze, which would force Eisenberg to buy more CRV as collateral in order to preserve his short position. This interpretation assumes that Eisenberg is trying only to short CRV and do nothing else.

This could indeed be true, but some analysts have suggested that Eisenberg's real target is Aave, from

Read more on cryptonews.com