Ethereum Price Prediction as ETH Spikes Up 10% in 7 Days – Here’s Where It’s Headed Next

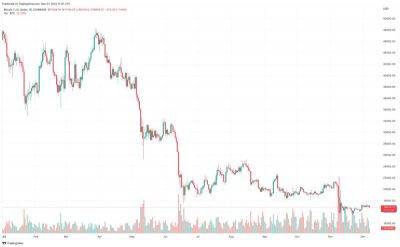

The price of Ether (or ETH), the token that powers the Ethereum blockchain network, was last up more than 10% in the last seven days according to CoinMarketCap data. Ahead of the start of Monday’s US session, ETH was last changing hands for just under $1,300 per token, up just over 2.5% in the last 24 hours and probing for a breakout to fresh near-one-month highs and a test of its 50-Day Moving Average just under $1,340.

Ether has rebounded about 20% in the last three weeks since forming a double bottom in the $1,080 area during November. Optimism about the US Federal Reserve slowing the pace of its monetary tightening in the coming months with US inflation showing clear signs of having peaked has lifted US stocks, bonds (meaning lower yields), many commodities and has weighed on the dollar since October. This trend has been giving tailwinds to crypto in recent weeks.

But ETH still has some way to go if it is to recoup its post-FTX collapse losses. Prior to the exchange’s untimely demise around this time last month, ETH/USD had been trading in the $1,550 to $1,650 area, about 20-25% above current levels. Crypto bulls will be hoping that as December progresses, Ether will recover back to these levels with the help of a “Santa rally” – a phenomenon where risk assets rally in the run-up to Christmas, as has historically been the case.

Ether has formed an ascending triangle in the last few weeks and looks to be on the verge of a short-term break to the upside. ETH/USD has been supported by an uptrend since the 22nd of November, but in the last few days, has been unable to get sustainably above $1,300. Price formations such as these are often considered precursors to a bullish breakout and, as such, price predictions have been

Read more on cryptonews.com