Best Crypto to Buy Now 7 April – LUNC, NEO, AAVE

In the week ahead, investors will confront new inflation data and the beginning of earnings season, while also keeping an eye on the Federal Reserve's potential plans for interest rates at their early May meeting.

How might this affect the selection of the best cryptos to buy now?

This coming week, the focus turns to two key inflationary indicators from the Labor Department: the Consumer Price Index (CPI) and the Producer Price Index (PPI).

The inflation numbers will likely influence the Fed's next move, but Wall Street is divided on whether interest rate hikes will persist.

On Wednesday, the Federal Reserve is set to release minutes from its March Federal Open Market Committee meeting, along with inflation data.

These minutes can offer insights into the Fed's overall policy stance and its future plans.

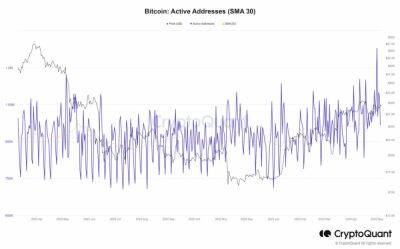

Meanwhile, the cryptocurrency market remains uncertain, with Bitcoin hovering around $28,000 amid concerns about a possible recession in the U.S. and the International Monetary Fund forecasting the slowest global economic growth in two decades.

Komodo's Chief Technical Officer, Kadan Stadelmann, stated that Bitcoin is currently experiencing mixed price trends and may still be affected by bear market woes.

The crypto market's liquidity may also be drying up due to the decreased stablecoin reserves on exchanges.

The current global crypto market capitalization is at $1.17 trillion, with Bitcoin and Ether accounting for 45.9% and 19%, respectively.

While Stadelmann predicts that Bitcoin may briefly surpass $30,000 next week, he warns of a possible recession impacting prices moving forward.

Despite the possibility of panic selling, he suggests that Bitcoin will quickly rebound due to its value as an alternative to traditional banking

Read more on cryptonews.com