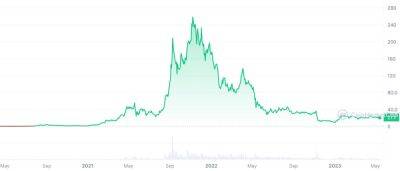

Bitcoin Price & Ethereum Prediction: BTC & ETH Dip by 3% - Anticipating the Week Ahead in Crypto Market

The cryptocurrency market has experienced a slight setback as both Bitcoin (BTC) and Ethereum (ETH) witnessed a dip of nearly 3% in their prices.

As the week unfolds, investors and traders are keenly observing the market trends, seeking insights on the possible future movements of these leading digital assets.

In this price prediction, we will delve into the factors influencing the market, analyze the recent price actions, and explore expert predictions to help you anticipate what to expect in the week ahead for the crypto market.

A noteworthy change in one of Bitcoin's (BTC) crucial indicators, which could substantially influence its price movement, has recently been detected according to fresh data.

This surprising development has piqued the interest of investors and analysts as they attempt to unravel its consequences for the cryptocurrency's path.

Moreover, certain reports indicate that the FTX collapse has contributed to a gradual transformation in the behavior of BTC holders.

Coins that have remained unspent since the incident are progressively becoming part of long-term holdings.

Bitcoin, like many financial assets, exhibits trends and patterns that can offer valuable insights into its price fluctuations.

Fresh data from Cryptoquant has unveiled an intriguing change in the pattern of Bitcoin's active addresses.

The chart shows that Bitcoin's price usually climbs following a hash rate drop when the number of active addresses exceeds a specific threshold.

For most of this year, the active addresses metric ranged from 900,000 to 1.1 million per day.

However, this pattern shifted on May 1st, as the active addresses metric soared to a new record of nearly 1.3 million – the highest figure in over a year.

This increase in

Read more on cryptonews.com