While Shiba Inu Price Explodes, These 3 Altcoins Might See 10x Gains

Shiba Inu has seen a sensational weekend following a protracted battle to breakout.

A huge 11% candle-wick saw SHIB price hammer up. Re-igniting what many had began to fear was a stalling rally.

2023 has now seen Shiba Inu climb 97% in just one month, with the 200 Day MA as steadfast iron support.

The veracity for volatility showcased by the seismic Bollinger band movements. This breakout has produced the widest signature since November - this isn't an ordinary move.

With an intra-day high of $0.00001576, price is currently trading at $0.00001442. This follows a minor rejection from the first key area of resistance at $0.000015.

Last week, when I predicted this move - I identified a likely rally 'top zone' - where chart structure may see fatigue.

On October 29 2022 (our most recent historic rally) SHIB saw a top at $0.000015. Before that, on August 14 2022 SHIB posted an impressive rally to $0.000018.

$0.000015-$0.000018 is thus the probable rally top.

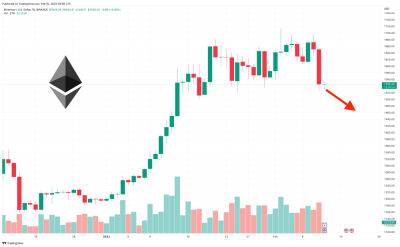

This is critically dependent on macro influence from Bitcoin (BTC) - a course for concern for some.

The leading cryptocurrency has seen stalled momentum give way to a slow bleed-out. Shiba Inu price action tends to follow major movements from BTC.

A glance at our indicators paints an even gloomier picture - much to the delight of bears.

The RSI 14 overheated significantly on this breakout from $0.000012. Hitting a top signal of 83 - this could be a sign to worry for SHIB holders.

83 is a very high RSI signature, that signals SHIB has become very overbought. The last time Shiba Inu hit 83 on the RSI was October 29 - the top of our last local rally at $0.000015 - the same level as now.

So the RSI 14 at the current level of 60 is bearish.

Bulls will be unhappy to see that the MACD has now

Read more on cryptonews.com