Ethereum price risks 20% correction amid SEC's crackdown on crypto staking

Ethereum's native token, Ether (ETH), saw its worst daily performance of the year as the U.S. Securities and Exchange Commission (SEC) stopped Kraken, a cryptocurrency exchange, from offering crypto staking services.

On Feb. 9, Kraken agreed to pay $30 million to settle the SEC's allegation that it broke securities rules by offering crypto staking services to U.S. retail investors.

The news pushed down the prices of many proof-of-stake (PoS) blockchain project tokens, in particular. Ethereum, which switched to a staking-based protocol in September 2022, also suffered as a result.

On Feb. 9, ETH's price plunged nearly 6.5% to around $1,525, the largest single-day decline since Dec. 16 of last year.

The SEC's crackdown on crypto staking begins as Ethereum awaits the release of its key network upgrade, dubbed Shanghai, in March.

The update will finally allow Ether validators — entities that have locked approximately $25.6 billion worth of ETH tokens in Ethereum's PoS smart contract — to withdraw their assets alongside yield rewards.

As a result, multiple analysts, including Bitwise Asset Management's Chief Investment Officer, Matt Hougan, consider Shanghai a bullish event for Ether.

"Today, many investors who would like to stake ETH and earn yield are sitting on the sidelines. After all, most investment strategies can’t tolerate an indefinite lock-up," wrote Hougan in his letter to investors in January, adding:

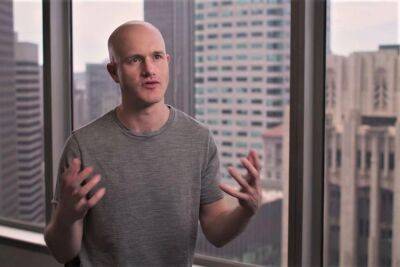

But doubts have been emerging about the future of crypto staking in the U.S., with Brian Armstrong, the CEO of Coinbase crypto exchange, fearing that the SEC would ban staking for retail investors in the future.

1/ We're hearing rumors that the SEC would like to get rid of crypto staking in the U.S. for retail customers. I

Read more on cointelegraph.com