Unless ministers listen, Treasury truth to power will not prevent further crises

The Treasury is an institution with a sense of history. Officials, as a matter of course, have a deep knowledge and understanding of economic crises of the past. The “pound in your pocket” devaluation of November 1967, the expansionary “Barber boom” initiated by the budget of March 1972, the IMF bailout of September 1976 and our ejection from the ERM in September 1992 will be all too familiar as case studies of failure from which lessons should be learned. To add to that list – perhaps the worst of the lot – will be Kwasi Kwarteng’s economic statement of 23 September 2022.

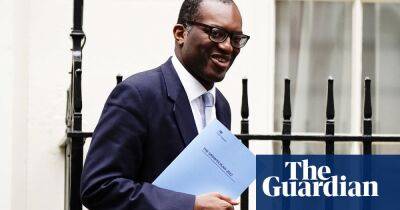

Culpability, of course, lies with ministers. A chancellor of the exchequer should have a feel for what the market will tolerate and the sense not to push their luck. Nonetheless, it would be no surprise if there is some soul-searching among senior officials as to whether more could have been done to warn the politicians that £45bn of unfunded tax cuts would break the markets’ patience. It did not help, of course, that their boss – Permanent Secretary Tom Scholar – had just been sacked for being insufficiently positive.

A willingness to tell truth to power is always necessary but it is particularly essential at the moment. We are not through this crisis yet. The currency and gilt markets remain jittery and, with the Conservative party conference commencing in Birmingham, every word said by the prime minister and chancellor will be closely scrutinised to see if they fully comprehend the situation. The evidence so far is not encouraging.

For much of the past week, ministers have attempted to deny that the market turbulence was the direct result of Kwarteng’s statement. They have also blamed the markets for failing to appreciate what they believe will be the

Read more on theguardian.com