Mini-budget will not lead to promised growth, leading economists tell MPs

Senior economists have dismissed Liz Truss’s chances of reaching 2.5% economic growth in the next few years, as they said her government’s “guerrilla tactics” in last month’s mini-budget played a major role in spooking markets.

Speaking to the Commons Treasury committee, the economists said the 2.5% growth target was “almost impossible”. The committee has launched its own investigation into the mini-budget in the absence of a formal forecast from the Office for Budget Responsibility.

The economists also dismissed the arguments of Jacob Rees-Mogg, the business secretary, that turmoil in pension funds had been caused by global factors alone, and warned that Kwasi Kwarteng, the chancellor, would need to unveil either spending cuts or tax increases to reassure markets in a promised statement on 31 October.

Answering questions from the cross-party committee of MPs, Jagjit Chadha, the head of the National Institute of Economic and Social Research (NIESR) thinktank, said confidence had been badly undermined by “what can only be described as guerrilla tactics against our independent economic institutions over the summer: the Treasury, the Bank of England and the OBR”.

He said: “There was a sense in which there was undermining of the cooperative arrangements that we had between the monetary and financial institutions, that theoretically and in practice have led to lower interest rates and lower deficits than would otherwise have to be the case.

“If you move away from that, what you’re going to have is a succession of higher interest rates and higher deficits than you would otherwise have.”

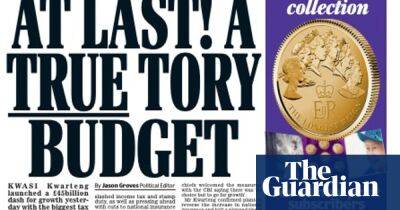

Kwarteng opted not to provide an OBR forecast of the consequences of his 23 September mini-budget, which will only come when he sets out his wider

Read more on theguardian.com