There’s a deeper story to Silicon Valley Bank’s failure. What can we learn from it?

On Friday, bank regulators closed Silicon Valley Bank, based in Santa Clara, California. Its failure was the second largest in US history and the largest since the financial crisis of 2008.

Will other banks fail? On Sunday, regulators closed New York-based Signature Bank.

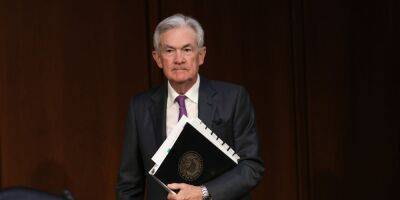

As they rushed to contain the fallout, government regulators at the Federal Reserve, Treasury and Federal Deposit Insurance Corporation announced in a joint statement on Sunday that depositors in Silicon Valley Bank would have access to all of their money starting Monday. They’d enact a similar program for Signature Bank.

They stressed that the bank losses would not be borne by taxpayers but by bank shareholders.

What happened?

The surface story of the Silicon Valley Bank debacle is straightforward. During the pandemic, startups and technology companies enjoyed heady profits, some of which they deposited in the Silicon Valley Bank. Flush with their cash, the bank did what banks do: it kept a fraction on hand and invested the rest – putting a large share into long-dated Treasury bonds that promised good returns when interest rates were low.

But then, starting a little more than a year ago, the Fed raised interest rates from near zero to over 4.5%. As a result, two things happened. The value of the Silicon Valley Bank’s holdings of Treasury bonds plummeted because newer bonds paid more interest. And, as interest rates rose, the gusher of venture capital funding to startup and tech companies slowed, because venture funds had to pay more to borrow money. As a result, these startup and tech companies had to withdraw more of their money from the bank to meet their payrolls and other expenses.

But the bank didn’t have enough money on hand.

There’s a deeper story here.

Read more on theguardian.com