US Fed faces internal probe over Silicon Valley Bank failure

The Federal Reserve is investigating the factors that led to the failure of Silicon Valley Bank — including how it supervised and regulated the now-collapsed financial institution.

In a Mar. 13 announcement, the Federal Reserve outlined that Vice Chair for Supervision Michael Barr is “leading a review of the supervision and regulation of Silicon Valley Bank, in light of its failure,” with a review set for public release by May. 1.

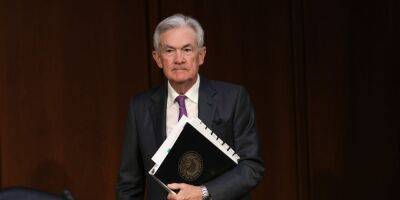

"The events surrounding Silicon Valley Bank demand a thorough, transparent, and swift review by the Federal Reserve," Chair Jerome Powell stated as part of the announcement.

@federalreserve announces that Vice Chair for Supervision Michael S. Barr is leading a review of the supervision and regulation of Silicon Valley Bank, in light of its failure. The review will be publicly released by May 1: https://t.co/wQ39KLiwHE

"We need to have humility, and conduct a careful and thorough review of how we supervised and regulated this firm, and what we should learn from this experience," vice chair Barr added.

SVB was shut down by the California Department of Financial Protection and Innovation on Mar. 10, with no specific reason offered behind the bank's forced closure.

However, prior to shutting down SVB was reportedly on the edge of collapse due to severe liquidity troubles relating to major losses on government bond investments and bank runs from spooked depositors.

It marked the second major U.S. bank in the same week to crumble following the bankruptcy of crypto-friendly Silvergate, with its parent company Silvergate Capital Corporation announcing a voluntary liquidation on Mar. 8.

Adding to the chaos, another crypto-friendly U.S. bank — Signature Bank — also went bust on Mar. 12 after the New York

Read more on cointelegraph.com