Stablecoin supplies and cash reserves in question amid crypto exodus

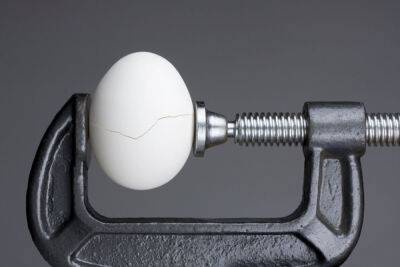

Cryptocurrency investors and traders have cashed out $7.7 billion from the stablecoin Tether (USDT) resulting in its market capitalization falling by 7.8% over the past seven days to $76 billion.

The amount withdrawn from the top stablecoin is nearly double the $4.1 billion it held in cash reserves at the end of 2021 according to Tether’s latest reserves report from December 2021.

To maintain Tether’s peg with the US dollar the company behind the token backs USDT with assets such as cash, bonds, and Treasury bills, the purpose being that each token is backed by at least $1 worth of assets.

According to the latest reserves report, the company had a total assets amount of at least $78.6 billion, around $4 billion or 5% of which was cash.

However, the firm seems to be able to maintain its cash reserves despite the “bank run” scenario caused by the collapse of the algorithmic stablecoin TerraUSD (UST) which had investors fleeing not only stablecoins but the entire crypto market for fear of collapse.

A separate transparency report updated daily shows that 6.36% of Tether’s assets are currently held in cash which would amount to roughly $4.8 billion if Tether’s reserves closely match the USDT market cap.

On May 12, market panic caused USDT/USD to trade under $0.99 on major exchanges, causing Tether to issue a statement at the time stating that it will honor all redemptions to $1.

https://twitter.com/Tether_to/status/152472463333705728

The same day, Tether’s Chief Technology Officer Paolo Ardoino said in a Twitter spaces chat that the majority of the company’s reserves are in U.S. Treasuries and that over the last six months it has reduced its exposure to commercial paper.

Related: Untethered: Here’s everything you need to know about

Read more on cointelegraph.com