SEC's crypto staking crackdown has uncertain consequences for DeFi: Lido Finance

A crackdown by the United States securities regulator on crypto staking could have unintended consequences for decentralized finance (DeFi), according to the head of business development at Lido DAO.

In a Feb. 13 Bloomberg report Jacob Blish, who leads business development at Lido's decentralized autonomous organization (DAO), said the most significant risk would be if the SEC eventually concluded that no U.S. citizen can interact with crypto staking services, including protocols.

"Then me, as a contributor to the DAO, does that mean I can't work on Lido anymore? Do I have to go leave and do something else?" Blish added.

The governance of Lido is managed by the Lido DAO with members from all over the world voting on critical decisions that steer the protocol.

In the wake of the SEC launching lawsuits and other enforcement actions against crypto firms, Blish joined a growing number of people in the crypto industry calling for more transparency around regulations and rules going forward, saying:

On Feb. 9 the SEC charged crypto exchange Kraken with "failing to register the offer and sale of their crypto-asset staking-as-a-service program" prompting the exchange to halt offering staking to its U.S. customers.

I honestly hope that somebody proves, in court, that there is a legal, user-friendly version of custodial staking that can be offered to US consumers. It’ll be a brutal, lengthy, expensive fight and a massive distraction but the industry and the USA will be extremely grateful. https://t.co/lhZPxykznD

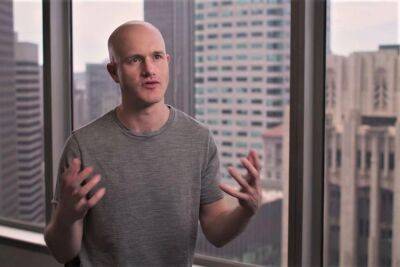

The SEC's latest action saw Coinbase co-founder & CEO, Brian Armstrong, defend staking in a Feb. 9 Twitter post, saying it would be “a terrible path for the U.S.” if a staking ban was to happen.

Related: Paxos facing

Read more on cointelegraph.com