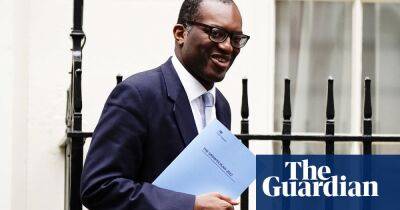

Pound’s plummet underlines schoolboy error by Kwasi Kwarteng

The savage sell-off in the pound in east Asia overnight was further evidence – should any be needed – that confidence in the new Liz Truss government is rapidly draining away.

Sterling fell to its lowest level against the dollar, and despite an attempt at a rally in early London trading, the likelihood is that parity against the dollar will be tested before long. September tends to be the month for a sterling crisis – and so it has proved again.

Part of the story of the pound’s weakness is a function of dollar strength but that does not explain why sterling has fallen so rapidly since the end of last week. There are three UK-related factors behind the fall.

First, once a currency hits the skids it is hard to stop it. Momentum trading took over in the aftermath of Kwasi Kwarteng’s mini-budget and it has proved hard to halt.

Second, Kwarteng committed a schoolboy error by pledging further tax cuts in a full budget planned for later this year. If the markets are worried about the state of the government’s finances and the increase in borrowing needed to fund your plans, it is not the wisest course of action to add to those concerns. Kwarteng’s inexperience has been exposed.

Third, the financial markets don’t really know how the Bank of England will respond to the events of the past three days. Threadneedle Street raised interest rates by half a point last Thursday but there has been speculation of an emergency meeting of the Bank’s monetary policy committee as early as Monday.

Paul Dales, the chief UK economist at Capital Economics, says a rate rise of one – or even one and a half – percentage points would give the markets some reassurance that the Bank was committed to returning inflation to its 2% target.

While that would look

Read more on theguardian.com