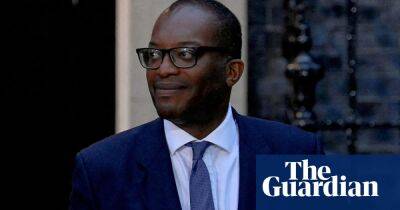

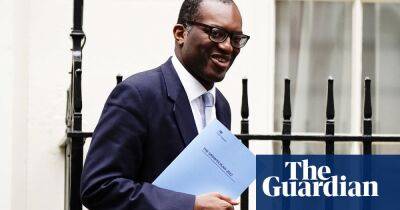

Tories pile pressure on Truss and Kwarteng to reverse tax-cutting plan

Liz Truss and Kwasi Kwarteng are under increasing pressure from Conservative MPs to U-turn on their tax-cutting plans as the pound tumbled again after the Bank of England’s emergency intervention.

Tory MPs expressed disbelief at how the government’s announcement had sunk sterling and caused market turbulence during the cost of living crisis and worst economic backdrop in a generation.

The veteran MP Bob Neill said the chancellor should rethink his decision to scrap the 45p top rate of income tax, which has been condemned by the opposition and which many MPs say has been received badly in their constituencies amid concerns over inflation.

He suggested to LBC News that the government’s predicament had been self-inflicted. “There’s been an error in the way the government has communicated this, because a lot of the proposals are very sensible and I would support them,” he said.

“We should think again about the top rate cut, the 45%, because I am concerned that we’re not paying enough attention to the dangers of inflation.”

The Tory chair of the Treasury select committee, Mel Stride, said the party must try to avoid a political crisis on top of an economic one. “The question is whether the plan is going to succeed. It’s had an adverse reaction from the markets,” he added.

Huw Merriman, the chair of the transport select committee, said polls suggested Truss was losing Tory votes by introducing exactly the policies that her leadership rival Rishi Sunak had warned about. He added: “For the good of our country, and the livelihoods of everyone in our country, I still hope to be proven wrong.”

Privately, MPs went further, suggesting the prime minister’s financial package had been a disaster for the Tories and only a reversal of Friday’s

Read more on theguardian.com