Litecoin Price Pumps to Over $6 Billion Market Cap - Analysts Tip This Utility Coin for Gains Next

Despite not having been named by the US Securities and Exchange Commission (SEC) as a crypto security in the agency’s double whammy of lawsuits against Binance and Coinbase announced earlier this week, the Litecoin (LTC) price is struggling.

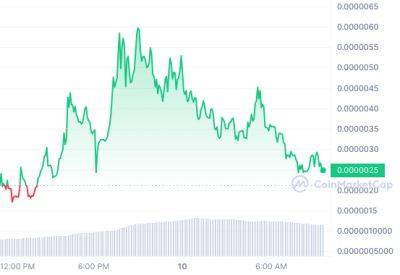

LTC/USD was last changing hands in the $87 area, down close to 7% on the week and down around 10% from the multi-week highs the coin printed over the weekend in the $97 area.

Still, Litecoin has managed to hold onto a market capitalization of over $6 billion.

The cryptocurrency’s market cap was last around $6.45 billion.

LTC bulls will take solace from the fact that Litecoin found support once again earlier in the week at its 200-Day Moving Average (DMA).

But bearish mid-week price action, with LTC having been unable to break back above its 21DMA on Wednesday and down more than 1% already on Thursday, a retest of the 200DMA looks to be on the cards.

But bulls fear not (not yet at least, anyway).

Litecoin continues to carve out a bullish long-term chart pattern that, coupled with important upcoming fundamental developments, could propel the cryptocurrency higher later this year.

Since last November, LTC has been in the process of forming a bullish ascending triangle pattern, with support coming in the form of an uptrend from last November’s sub-$50 lows and resistance coming in the form of early yearly highs in the $103-105 area.

Such formations typically form ahead of a major bullish breakout, hence why technical analysts are talking about the possibility that LTC can pump 50-60% from current levels to test major 2022 resistance points in the $135 to $145 area.

And the fundamentals appear to be there to support such a move.

As per a nicehash.com dashboard, the block reward for Litecoin miners

Read more on cryptonews.com