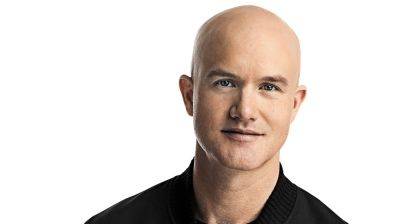

The US will find the 'right outcome' for crypto, eventually – Coinbase CEO

Brian Armstrong, the CEO of cryptocurrency exchange Coinbase, emphasized that regulating crypto isn't "rocket science" and is confident that the United States will achieve regulatory clarity, “even if it takes a while.”

Armstrong sat down for an interview with Wall Street Journal on June 11, just days after the SEC filed a lawsuit against Coinbase on June 6. The SEC alleged that Coinbase has been operating a securities exchange, broker-dealership and clearing house without registering with the commission.

Full WSJ interview on YouTubehttps://t.co/yIF3dGI7oN

Armstrong addressed the lawsuit in the WSJ interview, explaining that he believes those registrations weren't required for Coinbase to operate.

Despite not claiming that Coinbase is one, Armstrong noted that the exchange has faced difficulties in activating its broker-dealer license.

“We don’t claim to be a broker-dealer, we have acquired a broker-dealer license that is still dormant, because they won’t allow us to activate it” he said.

As for regulations, Armstrong explained that it isn’t “rocket science” and the U.S will acheive the “right outcome, even if it takes a while.”

He pointed out that the SEC v Coinbase lawsuit is important for the U.S. cryptocurrency industry as a whole, with hopes it will lead to more clarity and prevent the country from “falling behind” the rest of the world.

Armstrong is of the opinon that once there is clear and stable regulations regarding cryptocurrency in the U.S., it will encourage the return of crypto businesses to the country.

Cointelegraph previously reported on April 11 that the share of global crypto developers in the U.S. declined by 26% from 2018 to 2022, with the report citing “little regulatory clarity” as a major factor and as a

Read more on cointelegraph.com