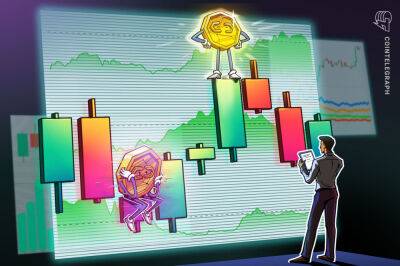

Litecoin hits fresh 2022 high versus Bitcoin — But will LTC price 'halve' before the halving?

Litecoin (LTC) has emerged as one of the rare winners in the ongoing cryptocurrency market meltdown led by the FTX exchange's collapse.

The 2011-born altcoin rallied nearly 16% month-to-date (MTD) to reach $62.75 on Nov. 22, outperforming its top rivals, Bitcoin (BTC) and Ether (ETH), which lo approximately 25% and 30%, respectively, in the same period.

Furthermore, the LTC/BTC price also rallied to new heights, gaining 50% in November to establish a new yearly high of 0.003970 BTC on Nov. 22.

As Cointelegraph reported, Litecoin diverged from the broader cryptocurrency market downtrend earlier this month with its halving slated for August 2023. LTC has also received an endorsement from none other than Michael Saylor for being a Bitcoin-like "digital commodity."

Michael Saylor says #Litecoin is also likely a digital commodity like Bitcoin: pic.twitter.com/7N19IpxtSe

Nonetheless, signs of bullish exhaustion are emerging.

Litecoin's rally versus Bitcoin has made the LTC/BTC pai overvalued, according to its weekly relative strength index (RSI) reading.

Notably, LTC/BTC's weekly RSI, which measures the pair's speed and change of price movements, surged above 70 on Nov. 22. An RSI reading above 70 is considered overbought, which many traditional analysts see as a sign of an impending bearish reversal.

Historically, Litecoin's overbought RSI readings versus Bitcoin have been followed by major price corrections. For instance, in April 2021, the LTC/BTC RSI's climb above 70 met with a strong selloff reaction, eventually pushing the pair down by 75% to 0.001716 BTC by June 2022.

Similarly, an overbought RSI in April 2019 led to a 70% LTC/BTC price correction by December 2019.

The same RSI fractal now hints at Litecoin's possibility of

Read more on cointelegraph.com