Kwarteng plan to lift cap on bankers’ bonuses infuriates unions

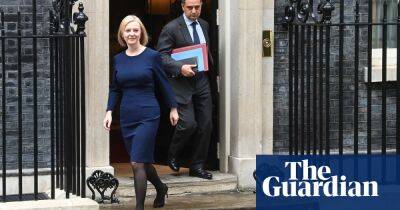

Unions have reacted with fury to the prospect of the government scrapping a cap on bankers’ bonuses, as ministers geared up for a return to near-normal politics next week, topped by an emergency mini-budget on Friday.

Kwasi Kwarteng, the chancellor, who will set out plans for tax cuts and give more details about the government’s plans to limit rising energy bills, is also considering whether to shed the legacy of an EU-wide cap on bonuses of twice an employee’s salary, imposed after the 2008 financial crash.

While the cap was intended to curb over-risky practices that helped create the crash, ministers are known to be concerned that the City it at risk of losing out to other financial centres.

According to the Financial Times, Kwarteng wants to abolish the rules as part of what he calls “big bang 2.0”, a post-Brexit deregulation drive to make the City more competitive.

Sources told the paper that Kwarteng wants to boost the City’s competitiveness against New York, Frankfurt, Hong Kong and Paris, with one financier saying an end to the cap was a “clear Brexit dividend. Something you can present as a win.”

It would, however, be a politically perilous move at a time when the bulk of UK households are facing real-terms pay decreases amid 9.9% inflation, as well as notably higher energy bills this winter, despite the government plan to cap increases.

Frances O’Grady, the general secretary of the TUC, said people “are being walloped by soaring prices after the longest and harshest wage squeeze in modern history”. She added: “The chancellor’s No 1 priority should be getting wages rising for everyone – not boosting bumper bonuses for those at the top.”

Sharon Graham, the general secretary of the Unite union, said workers would be

Read more on theguardian.com