I asked ChatGPT what’s next for Binance Coin after CFTC’s lawsuit and it told me…

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

Binance’s ecosystem has been at the receiving end of an unrelenting regulatory pushback in the first quarter of 2023, casting serious concerns on the future of one of the largest entities in the crypto-space.

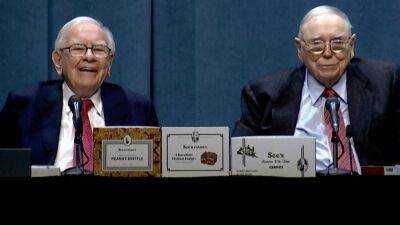

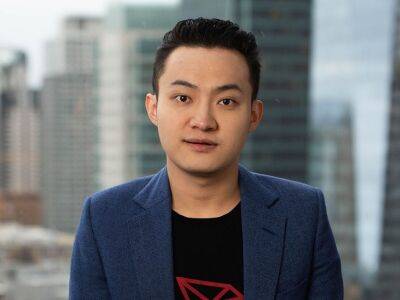

The latest salvo directed at the crypto-behemoth was the lawsuit by U.S. Commodity Futures Trading Commission (CFTC), accusing the exchange and Founder Changpeng Zhao (CZ) of violating local compliance rules to expand its business.

Earlier in February, Paxos, the issuer of the Binance branded stablecoin BUSD, was directed by the New York Department of Financial Services (NYDFS) to stop minting new tokens. The action, according to the regulator, was brought about by “several unresolved issues related to Paxos’ oversight of its relationship with Binance.”

The impact of these crackdowns has been severe. According to a report by crypto-market data provider Kaiko, Binance lost 16% share of global trading volume in Q1 2023. The lawsuit-induced FUD resulted in a radical shake-up of its exchange reserves with users withdrawing funds for self-custody.

Moreover, the net stablecoin outflow reached -$295 million/day recently, which was the largest net outflow in the history of the world’s largest crypto-exchange. Stablecoin liquidity is one of the most crucial parameters to gauge the health of a crypto-trading platform.

The future course for Binance and its native token Binance Coin [BNB] is shrouded in uncertainty. And, most of the investors and analysts in the space would be busy understanding the dynamics to make informed decisions going forward. We, at AMB Crypto, tried to get some

Read more on ambcrypto.com