Hindenburg Research goes after Carl Icahn in latest campaign for market-moving short seller

Notable short seller Hindenburg Research is going after famed activist investor Carl Icahn.

The Nathan Anderson-led firm took a short position against Icahn Enterprises, alleging «inflated» asset valuations, among other reasons, for what it says is an unusually high net asset value premium in shares of the publicly traded holding company.

«Overall, we think Icahn, a legend of Wall Street, has made a classic mistake of taking on too much leverage in the face of sustained losses: a combination that rarely ends well,» Hindenburg Research said in a note released Tuesday.

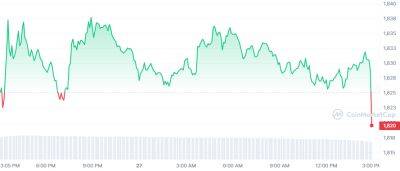

The shares fell 9% in premarket trading.

Icahn, the most well known corporate raider in history, made his name after pulling off a hostile takeover of Trans World Airlines in the 1980s, stripping the company of its assets. Most recently, the billionaire investor has engaged in activist investing in McDonald's and biotech firm Illumina.

Headquartered in Sunny Isles Beach, Florida, Icahn Enterprises is a holding company that involves in a myriad of businesses including energy, automotive, food packaging, metals and real estate.

The conglomerate pays a 15.9% dividend, according to FactSet. Hindenburg said it believes the high dividend yield is «unsupported» by the company's cash flow and investment performance.

CNBC has reached out to Icahn for comment.

Shares of Icahn Enterprises are down 0.5% on the year as of Monday's close.

Read more on cnbc.com