Florida pension fund sues Elon Musk and Twitter to stop buyout

Elon Musk and Twitter were sued on Friday by a Florida pension fund seeking to stop Musk from completing his $44bn takeover of the social media company before 2025.

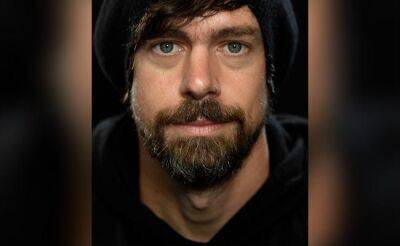

In a proposed class-action lawsuit filed in Delaware Chancery court, the Orlando police pension fund said Delaware law forbade a quick merger because Musk had agreements with other big Twitter shareholders, including his financial adviser Morgan Stanley and Twitter founder Jack Dorsey, to support the buyout.

The fund said those agreements made Musk, who owns 9.2% of Twitter, the effective “owner” of more than 15% of the company’s shares. It said that required delaying the merger by three years unless two-thirds of shares not “owned” by him granted approval.

Morgan Stanley owns about 8.8% of Twitter shares and Dorsey owns 2.4%.

Musk hopes to complete his $54.20 a share Twitter takeover this year, in one of the world’s largest leveraged buyouts.

Musk, the world’s richest person, also runs electric car company Tesla and leads The Boring Co and SpaceX.

Twitter and its board, including Dorsey and CEO Parag Agrawal, were also named as defendants.

Twitter declined to comment. Lawyers for Musk and the Florida fund did not immediately respond to requests for comment.

The lawsuit also seeks to declare that Twitter directors breached their fiduciary duties, and recoup legal fees and costs. It did not make clear how shareholders believed they might be harmed if the merger closed on schedule.

On Thursday, Musk said he had raised about $7bn, including from investors like the tech tycoon Larry Ellison, the Qatar state investment fund and the world’s biggest cryptocurrency exchange, to help fund the takeover.

According to the filing with the US Securities and Exchange Commission,

Read more on theguardian.com