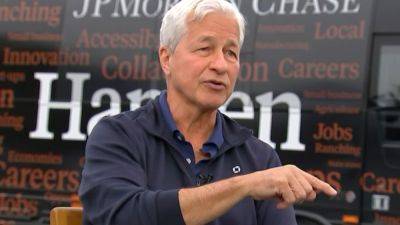

Federal Reserve Chair Jerome Powell Talks US Economy and Inflation at Economic Club of New York

Today, Federal Reserve Chair Jerome Powell addressed critical economic issues facing the United States in a talk at the Economic Club of New York.

During the speech, Powell discussed the state of the U.S. economy, recent monetary policies, and future plans of the Federal Reserve. The topics that dominated the conversation were the strength of the labor market, ongoing inflation, and the Fed's monetary policy.

The discussion held importance in light of the upcoming Federal Open Market Committee meeting scheduled for October 31-November 1.

Jerome Powell's remarks came at a crucial time when inflation in the US has been a dominant concern. Powell observed that inflation remains elevated, above the Federal Reserve’s target of 2%.

He pointed out that a return to this target level may necessitate below-trend growth and some adjustments in labor conditions. He also indicated that the effects of previous interest rate hikes by the Fed may not have fully trickled down into the economy.

"Achieving this goal might require a period of below-trend growth and some softening in labor market conditions," Powell said.

The Chairman acknowledged the vigor of the US economy, referring specifically to the tight labor market. Interestingly, the unemployment rate has stayed stable at 3.8% despite interest rate increases since March 2022. This defies expectations, as the economy has been performing above its anticipated annual growth rate of 1.8%.

"The unemployment rate remains stable at 3.8%, showcasing an economy performing above the anticipated growth rate of 1.8% annually," Powell commented.

He also flagged evidence of the labor market returning to pre-pandemic levels, however, suggesting that the market may be cooling.

Powell drew attention to

Read more on cryptonews.com