Enabling Innovation in Asset Management: SFC's Approach

Key Takeaways

SFC's Dual Role in Asset Management

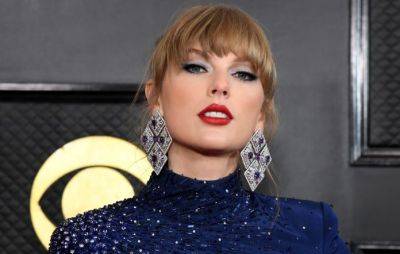

Christina Choi, Executive Director of Investment Products at the Securities and Futures Commission (SFC), addressed the Bloomberg Buy-Side Forum in Hong Kong on September 26, 2023. She outlined the SFC's dual role: protecting investors and upholding market integrity, and strengthening Hong Kong's position as a global asset management hub. The SFC aims to balance regulation and innovation, ensuring that technology advancements like AI and blockchain can be integrated into the asset management industry without compromising market integrity.

Technology's Impact on Asset Management

Choi highlighted the rapid advancements in technology, specifically mentioning the miniaturization of chip technology from 90 nanometres to just three nanometres in two decades. She linked these technological leaps to the potential for «tiny changes» in the asset management industry that could result in significant market development.

Tokenization of Retail Investment Products

One of the most notable points in Choi's speech was the discussion on tokenization of SFC-authorized investment products. Tokenization refers to the use of blockchain technology to create digital tokens that represent fractional ownership in an investment product. Choi mentioned that the SFC is currently working on detailed guidelines for tokenization, particularly focusing on primary dealing at this stage due to the nascent state of Virtual Asset Trading Platforms (VATPs) in Hong Kong.

Regulation Enables Innovation

Choi stressed that while innovation is crucial, it must be balanced with robust regulation to ensure sustainable development and investor protection. She cited historical examples like the Global

Read more on blockchain.news