Bank of Canada Assesses DeFi’s Innovation and Challenges on Financial Markets

The Bank of Canada published a staff analytical note that mirrors the development of decentralized finance (DeFi) alongside possible routes of wider market regulations.

The staff note released on Oct 17 shows the development stages of the cryptocurrency market, its benefits, challenges facing traditional finance, risk, and possible impact on financial markets alongside regulations.

Per the report, crypto assets were initially developed as a payment system deployed on the blockchain before diversifying into new fields of financial services.

To achieve its decentralization aim, it uses smart contracts doing away with third parties to settle multiple transactions, creating a service eventually spiraling into a $2.9 trillion market cap before major platform collapses and regulatory hurdles sent prices plunging.

From non-fungible tokens, decentralized stablecoin, and leading services, a whole new niche has rolled out with the asset class alongside new risks in the present market.

One benefit of the ecosystem highlighted by the bank is the composability of smart contracts making it easy for more companies to create services.

This is due to the open-source nature of their code allowing developers to collaborate and build on top other networks.

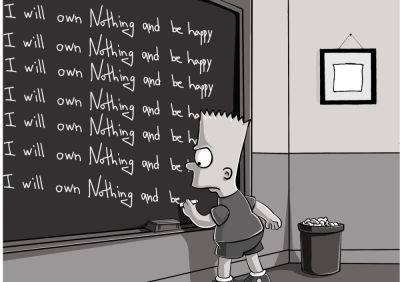

The bank also listed increased service offerings, increased competition, and transparency as reasons for making the ecosystem more attractive than traditional finance products.

Determined to end financial monopolies, cross-border payments of most services allow for payments between countries, and with the rise of interoperability, users enjoy seamless experiences without struggling on multiple platforms.

DeFi can also reduce frictions in the financial markets faced with limited and opaque

Read more on cryptonews.com