Crypto funding shifts from CeFi to DeFi after major collapses: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week.

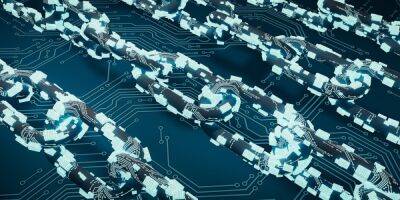

DeFi has become a prominent choice for investors after multiple centralized finance (CeFi) collapses throughout 2022. Some key interest areas for investors include “NFTfi,” on-chain derivative platforms, decentralized stablecoins and Ethereum layer 2’s.

February saw seven DeFi exploits resulting in a net loss of about $21 million. March is no different, with multiple exploits already recorded, such as on Hedera’s mainnet. DeFi lender Tender.fi was exploited, but the white hat hacker that drained $1.59 million returned the funds.

Tornado Cash developers said that a new version of the mixing tool would aim to be more regulator friendly, where law enforcement can differentiate between the legal and illegal transfer of funds.

The DeFi market had a bearish past week, with most of the tokens in the top 100 trading in the red thanks to the new federal budget and Fed rate hike.

Digital asset investment firms poured $2.7 billion into decentralized finance projects in 2022 — up 190% from 2021 — while investments into centralized finance projects went the other way — falling 73% to $4.3 billion in the same timeframe. The staggering rise in DeFi funding came despite overall crypto funding figures falling from $31.92 billion in 2021 to $18.25 billion in 2022.

According to a March 1 report from CoinGecko, citing data from DefiLlama, the figures “potentially point to DeFi as the new high growth area for the crypto industry.” The report says the decrease in funding toward CeFi could point to the sector “reaching a degree of saturation.”

Continue reading

Reentrancy,

Read more on cointelegraph.com

cointelegraph.com

cointelegraph.com