3 Reasons Crypto Prices are Rising Today – New Bull Market Starting?

Financial markets have been engulfed with fear in recent days, as fears that a tumultuous sequence of banking crises could become a contagion in the sector.

It all started with the closure of Silvergate Bank's SEN payment network (key backend crypto industry infrastructure) following a run on deposits back in November.

This was quickly followed by the implosion of Silicon Valley Bank - the 16th largest bank in America - and a bastion of start-up capital and VC funding.

This, too, was driven by a run on deposits, after gruesome details emerged surrounding the performance of SVB's bond portfolio in the face of high-interest rates.

Representing the biggest banking collapse since 2008, concerns around the potential spread of a banking contagion took hold.

US bank stocks were battered Friday, with some stocks down as much as -35%.

And this damage continues to spread today, with several US bank stocks seeing trading halted.

The S&P500 went negative year to day this morning - as the Dow Jones and NASDAQ took a hammering.

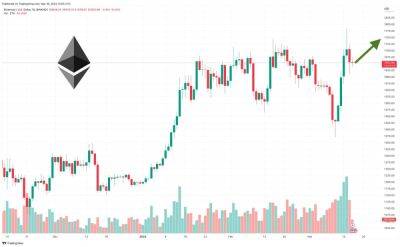

Meanwhile, Bitcoin (BTC) has surprised markets – with an encouraging bounce back above $20,000 being described as a ‘Cyprus moment‘ as investors race to find safer havens for capital outside of the fractional reserve banking system.

Here are three reasons that help to explain why crypto prices are soaring despite the banking chaos this week.

The Federal Deposit Insurance Corporation (FDIC) began selling SVB assets to repay up to 50% of deposits to SVB clients today,

This comes as a substantial relief to the legions of USDC holders that held with despair as USDC depegged over the past few days.

The depeg came after a tweet from Circle revealed their exposure to the Silicon Valley Bank crisis.

As investors flocked to move

Read more on cryptonews.com