Citi to sell consumer business in Malaysia, Indonesia, Thailand and Vietnam to UOB Group

In this article

Citigroup will sell its consumer banking businesses in Indonesia, Malaysia, Thailand and Vietnam to Singapore's United Overseas Bank, the banks announced Friday.

As part of the deal, UOB said it will acquire Citi's unsecured and secured lending portfolios, wealth management and retail deposit units that make up its consumer banking business in the four markets.

UOB, which has a prominent presence in Southeast Asia, will pay Citigroup for the net assets of the acquired businesses as well as a premium of $690 million.

Citi's consumer business had an aggregate net value of about 4 billion Singapore dollars ($2.97 billion) and a customer base of approximately 2.4 million as of June 30, 2021, UOB said.

The proposed transaction is expected to be financed through the bank's excess capital and is estimated to reduce UOB's common equity tier 1 ratio — which measures a bank's capital in relation to its assets — by 70 basis points to 12.8%, UOB said. It added that the impact on the CET1 ratio is not expected to be material and will remain within regulatory requirements.

«UOB believes in Southeast Asia's long-term potential and we have been disciplined, selective and patient in seeking the right opportunities to grow,» Wee Ee Cheong, deputy chairman and chief executive officer at UOB, said in a statement.

Approximately 5,000 Citi consumer banking staff and supporting employees in the four markets are expected to transfer to UOB when the proposed deal closes.

«The acquired business, together with UOB's regional consumer franchise, will form a powerful combination that will scale up UOB Group's business and advance our position as a leading regional bank,» Wee said.

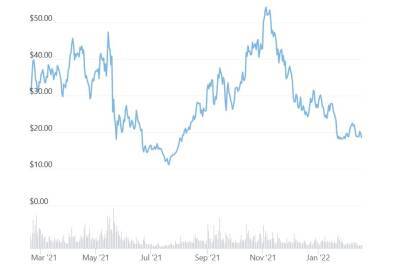

UOB shares ticked higher by 1.23% Friday afternoon,

Read more on cnbc.com