Canada Sets Strict CIRO Compliance Deadline for Crypto Trading Platforms

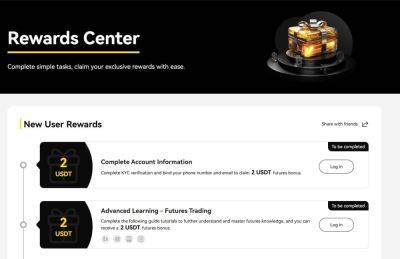

Canada-based crypto trading platforms (CTPs) are facing tight regulatory deadline from the Canadian Investment Regulatory Organization (CIRO). The crypto operators are required to comply with the deadline to complete their applications to receive an investment dealer status.

The Canadian Securities Administrators (CSA) has “reminded” CTPs to adhere to CIRO membership requirements, ensuring regulatory alignment and customer protection.

In 2021, the CSA and CIRO detailed that CTPs were allowed to operate as restricted dealers for temporary period. During the period, they would offer services, while seeking for fully authorized CIRO membership.

However, as the transitional period comes to an end, the regulators in Canada have stipulated deadlines for crypto platforms to move from restricted dealers to fully-authorized.

“Given the time that has passed, CSA members expect CTPs to have carefully reviewed and understood the requirements to become investment dealers and CIRO members, and be actively engaged with CIRO on their applications.”

This is because the CSA members do not intend to continue with a time-restricted dealer registration for CTPs.

Per a KPMG report, 50% of the financial services in Canada offer at least one cryptocurrency feature for their clients. The bi-annual survey noted that about 52% offered crypto asset trading.

The crypto services expansion has come in response to high client demand, with 8 in 10 platforms citing high appetite for crypto from retail investors.

Further, spot Bitcoin exchange-traded funds (ETFs) have been available in Canada since 2021. As a result, there are several options for Canadians to invest in. However, Canadian financial institutions experienced severe outflows, losing a staggering

Read more on cryptonews.com