Buyer confidence wanes as Axie Infinity [AXS] drops below $13

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

Axie Infinity [AXS] was rejected at the $13.1-resistance level for the third time since mid-September. The number has indeed been unlucky for AXS bulls or lucky from the bears’ perspective. With Bitcoin unable to scale the $20.5k-$20.8k resistance zone as well, it appeared that the next week or two could see selling pressure intensify.

To the south, AXS has strong support near $10. Can the buyers have any say in the market in the coming days?

Source: AXS/USDT on TradingView

The momentum indicator showed that since August, AXS has seen strong downward momentum. The RSI has been below neutral 50 for most of the time from early August to press time. On the other hand, the OBV formed higher lows in recent weeks. This suggested steady buying volume, despite the downtrend of the price. Can a strong rally be around the corner?

If Bitcoin can swiftly climb past the $20.8k-resistance, it could shift the sentiment to strongly bullish for many altcoins. For AXS, the $12.5 and $13-levels have been strong supports in the past. Further south, $10.6 and $9.2 are also long-term supports.

The Fibonacci extension levels (yellow) show a good confluence with the aforementioned horizontal levels. This confluence could materialize in a bullish reaction for AXS at the $10.7-$10.6 belt and $9.2 support as well. A revisit to the $13-mark would likely offer a good risk-to-reward opportunity to enter a short position.

$11.6, $10.7, and $9.2 can be used to take a profit. Invalidation of this bearish notion would be a session (12-hour or daily) above $13.6.

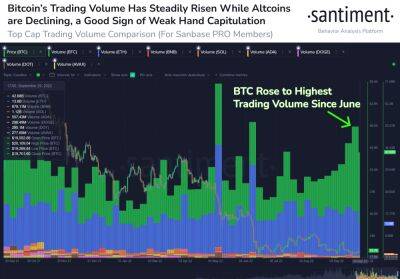

Source: Santiment

The social volume weighted

Read more on ambcrypto.com

![As Axie Infinity [AXS] prepares for recovery, why long bets may not be ideal - ambcrypto.com](https://finance-news.co/storage/thumbs_400/img/2022/10/7/44070_8mg.jpg)