Bitcoin Showing Bullish Signs – Exchange Outflows See Significant Uptick

Bitcoin (BTC) is again showing signs of bullishness, with outflows from crypto exchanges and into personal wallets now seeing a significant uptick.

In a post published on the crypto analytics platform CryptoQuant, the exchange outflows were described as “very significant” and “the highest amount in months,” amounting to more than 61,000 BTC in the past three days alone.

“After months of [lower] prices, this is a sign of demand coming back into the market,” the post, written by the user Maartunn, said.

Exchange outflows are generally seen as bullish for crypto prices, as it indicates that investors have long-term convictions in the asset and are not planning to sell again in the near term. Conversely, exchange inflows are seen as bearish as it can be a sign that investors are losing confidence and are therefore sending coins to exchanges to be sold.

Meanwhile, bitcoin balances held on exchanges have also seen a consistent downtrend in recent months after spiking back in early August.

The sharpest fall in bitcoin balances came between September 29 and October 1, when the level dropped from 2.14m BTC to 2.08m across all major exchanges, per data from Coinglass. All else equal, lower amounts of bitcoin held on exchanges is seen as bullish for the price.

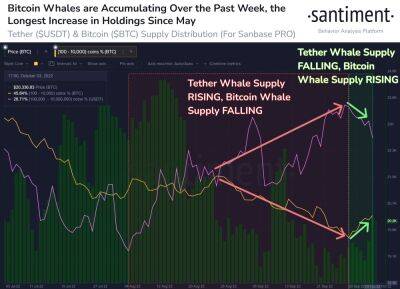

In the past, several theories have been discussed as the reason for the lower exchange balances of bitcoin. Some insiders point to over-the-counter (OTC) deals as one explanation, while others say an increase in the bitcoin whale population shows that large holders increasingly prefer to take full control of their own coins.

As of press time at 10:00 UTC, BTC is trading at $19,166, down a mere 0.5% for the past 24 hours but up 1.9% on a 7-day basis.

Read more on cryptonews.com

cryptonews.com

cryptonews.com

![Bitcoin [BTC] is finally seeing green, but what role did the whales play - ambcrypto.com - city Santiment](https://finance-news.co/storage/thumbs_400/img/2022/10/6/43879_jhn.jpg)