Bitcoin traders bet on $24K BTC price as market digests SEC vs. Binance

Bitcoin (BTC) circled $25,800 on June 6 as the aftermath of fresh panic over largest exchange Binance lingered.

Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it steadied after dropping to near three-month lows.

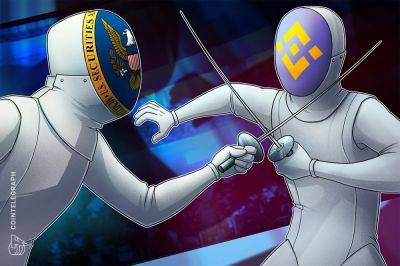

The weakness came as part of a knee-jerk market reaction to news that United States regulators were suing Binance and its CEO, Changpeng Zhao, also known as CZ, over “a variety of securities law violations.”

“Through thirteen charges, we allege that Zhao and Binance entities engaged in an extensive web of deception, conflicts of interest, lack of disclosure, and calculated evasion of the law,” SEC Chair Gary Gensler stated in part of a press release.

Wonder if he ever reads the comments under his post, from the consumers he is suppose to protect. https://t.co/xQjC872GsD

While sparks continued to fly between the exchange and the U.S. Securities and Exchange Commission (SEC) — even on social media — Bitcoin traders looked to what a recovery might look like.

Popular trader Crypto Ed considered $26,200 as a bounce target before fresh downside kicked in thanks to a lack of spot buyer demand.

“I think we’re pretty close to a bounce, but could be a short-term bounce,” he summarized in a dedicated YouTube market update following the Binance news.

Crypto Ed added that his downside target lay at or just above the $24,000 mark.

Fellow trader Crypto Tony agreed, sharing a similar mid-term roadmap for BTC price.

“Shed some more profit on my short this morning, but now looking for a relief wave before the final leg down towards $24,500,” he told Twitter followers.

On the day, trading suite Decentrader warned over a high long/short ratio on Bitcoin, this even beating levels seen after the implosion of exchange

Read more on cointelegraph.com