Bitcoin: Assessing the impact of BTC’s correlation with traditional markets

No thanks to the worsening macroeconomic conditions, the cryptocurrency market was severely beaten down in the last quarter, a new report from Cryptorank (an analytics platform) showed.

Following the severe decimation in the prices of many cryptocurrency assets that plagued the first half of the year, Q3 opened with a positive price correction for many assets.

The global cryptocurrency market capitalization recovered to consolidate above the $1 trillion range. The prices of leading assets such as Bitcoin [BTC] and Ethereum [ETH] rallied by 18% and 56% in the first 31 days of Q3.

However, as the quarter progressed, the market suffered deterioration, and as pointed out by Cryptorank, “even major events such as Ethereum’s Merge did not lead to significant positive movements.”

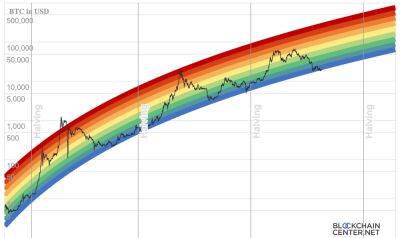

According to Cryptorank, the leading cryptocurrency BTC suffered a 2% decrease in its price between July and September. While its price rallied by 18% in July, BTC proceeded to shed most of its gains between August and September.

Source: Cryptorank

This led it to close the quarter below the $20,000 price region. As noted in the report, historically, “cryptocurrencies tend to perform poorly in these two months.”

It is known that September, historically, has been one of the worst months for BTC. The asset’s price “has averaged an 8.5% drop for the month over the past five years.”

Source: Bloomberg

Cryptorank found further that BTC’s correlation with traditional financial markets rallied in Q3, causing it to near an all-time high.

As a result of this correlation, the asset’s “connection with the global macroeconomic situation has significantly increased,” making it “sensitive to announcements such as inflation data or Fed rate hikes.”

For example, at the last

Read more on ambcrypto.com

ambcrypto.com

ambcrypto.com

![Solana [SOL] presents an attractive risk-to-reward buying opportunity, but… - ambcrypto.com - city Santimentthe](https://finance-news.co/storage/thumbs_400/img/2022/10/11/44363_a2j.jpg)

![With Bitcoin [BTC] near its range lows again, here’s what’s next - ambcrypto.com](https://finance-news.co/storage/thumbs_400/img/2022/10/11/44348_rsq.jpg)

![Brazil: USDT, Bitcoin [BTC], and…? New crypto-declarations suggest… - ambcrypto.com - Usa - Brazil](https://finance-news.co/storage/thumbs_400/img/2022/10/10/44336_y5v.jpg)

![This Bitcoin [BTC] metric is high and whales may have something to do with it - ambcrypto.com - city Santiment](https://finance-news.co/storage/thumbs_400/img/2022/10/10/44306_fruul.jpg)