Bitcoin price rejection at $39K and mounting regulatory concerns tank the market again

Volatility and choppy price action continued to dominate the cryptocurrency market on March 7 and news that United States President Joe Biden plans to sign an executive order later this week that will outline the government's strategy for cryptocurrencies was added to the list of factors weighing down crypto prices.

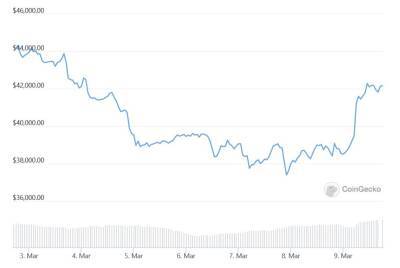

Data from Cointelegraph Markets Pro and TradingView shows that Bitcoin (BTC) bulls were thwarted in an attempt to regain support at $40,000 on Monday as revelations about the upcoming executive order and the ongoing conflict in Ukraine tanked the market and dropped BTC to a low of $37,155.

Here’s what several analysts in the market are saying about the outlook for BTC and whether or not crypto traders should prepare for an extended bear market.

A bearish perspective for the current price action was outlined by crypto trader and pseudonymous Twitter user ‘Crypto Tony’, who posted the following chart outlining the potential for a capitulation into the low $20,000s for BTC if the current support levels break down.

Crypto Tony said,

A more optimistic take on the current weakness was offered by analyst and Cointelegraph contributor Michaël van de Poppe, who posted the following chart outlining a possible pullback in BTC price to the low $36,000 range.

van de Poppe said,

Technical evidence that the BTC price could soon mount a recovery was highlighted by crypto trader and host of The Wolf of All Streets podcast Scott Melker, who posted the following chart noting that “My favorite signal is present - bullish divergence with oversold RSI on the 4-hour chart.”

Melker said,

Related: Ethereum risks crashing under $2K as ETH paints bearish ‘symmetrical triangle’ — Analyst

An attempt to put those concerned with the

Read more on cointelegraph.com