Bitcoin, Ethereum Slide, Liquidations Soar as Market Awaits US Inflation Numbers

Bitcoin (BTC), ethereum (ETH), and much of the broader crypto market traded sharply lower today, with liquidations of leveraged long positions amplifying the price drop. The crash comes as the market prepares for yet another high US inflation figure, and follows a jump in prices yesterday after details on an Executive Order on crypto in the US became known.

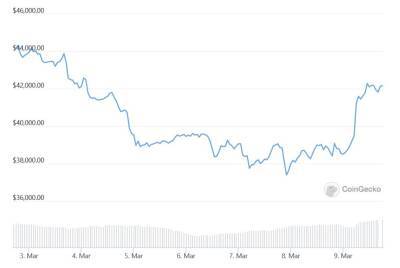

Following a drop in the price of BTC of more than 7% as of 10:40 UTC to USD 39,245, liquidations of leveraged long positions in the bitcoin futures market also shot up.

At press time, nearly USD 43m in leveraged bitcoin longs had been liquidated during the 12 hours from midnight to noon UTC time on Thursday across exchanges. Notably, the long liquidations today followed a similar level of liquidations on the short side yesterday, when nearly USD 63m in bitcoin shorts were liquidated during the same time period.

For the crypto market as a whole, liquidations of long positions reached USD 108m during the same 12 hours today, data from the market tracking site Coinglass showed.

Bitcoin futures liquidations per 12 hours:

Along with the falling crypto prices, US S&P 500 stock index futures pointed to an opening lower on Wall Street, after a positive day yesterday.

The price of gold also continued lower in the early hours of European trading today after getting slammed yesterday from a high of USD 2,070, just USD 5 shy of an all-time high for the metal. As of press time, however, gold had once again staged a comeback, moving from a low of USD 1,970 to 1,997.

Yesterday, bitcoin and crypto more broadly surged higher in price after US President Joe Biden signed an Executive Order on digital assets that the market perceived as a generally positive step from the US government in its

Read more on cryptonews.com