Bitcoin Price Prediction: BTC Above $65K Amid $100M Andrew Tate Investment and Supply Lows

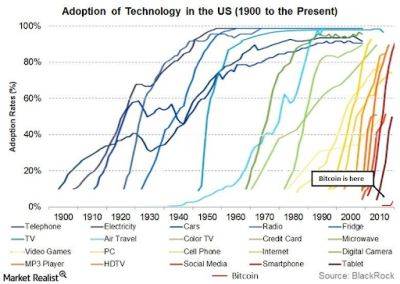

Bitcoin is trading just above $65,000, experiencing a 1.25% correction after a recent surge. This upward movement was driven by weaker US CPI data, dovish FOMC sentiment, and a break from a symmetrical triangle pattern.

Despite this slight bearish correction, the Bitcoin price prediction remains bullish, especially with Andrew Tate’s announcement to invest $100 million in Bitcoin and decreasing BTC supply on exchanges.

Bitcoin (BTC) supply on centralized exchanges (CEX) has dropped to new lows following strong market activity over the past 48 hours. According to on-chain analytics firm Glassnode, the Bitcoin supply on exchanges is now at 1,728,782 BTC, reflecting a significant decrease as bullish sentiment grows.

In the last 24 hours, 23,654 BTC exited exchanges, with weekly outflows reaching 19,859 BTC. Monthly flows were also down, with only 9,509 BTC moving. This reduction suggests increasing bullish pressure as traders move their assets off exchanges.

Key Points:

This week, several traditional finance firms disclosed their exposure to spot Bitcoin ETFs, further driving prices up.

Andrew Tate, a British-American social media personality and former professional kickboxer, has announced plans to invest heavily in bitcoin, expressing his dissatisfaction with traditional banks and their practices.

“I’m about to leave fiat completely,” Tate declared. “I’m done with banks and their scams.”

Tate shared his plans on the social media platform X, stating his intention to move away from fiat currency and invest $100 million in bitcoin.

I know I’m not supposed to do this in chaotic times but I’m about to leave fiat completely and ape over 100M into btc.

And I’ll even prove I did it.

I’m done with the banks.

I’m done with

Read more on cryptonews.com