Bitcoin price bottom not in, data says as whale orders hit 2-year low

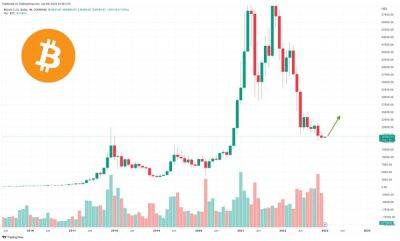

Bitcoin (BTC) is not about to bottom at just below $17,000, new analysis warns as bid liquidity dries up.

In social media posts after Christmas, on-chain analytics resource Material Indicators flagged waning interest in protecting the current BTC price range.

With volatility still largely absent from Bitcoin markets, analysts are keenly eyeing what could happen at this week’s yearly close.

The closing price for BTC/USD on Dec. 31 will also mark the conclusion of the weekly and quarterly candles, and any flash volatility could turn 2022 into a nightmarish bear market year.

As Cointelegraph reported, the pair is currently down around 60% year-to-date, while versus its latest all-time high from November 2021, it has lost 76%.

This may still not be enough to cap the bear market, various analysts have warned, and now, order book data appears to underscore the potential for fresh losses.

“Nothing illustrates sentiment for a price level like liquidity, and there does not appear to be much sentiment for this price level being the bottom,” Material Indicators commented on a chart of BTC/USD order book activity on Binance.

The day prior, another post argued that there was not “much to be excited about” given current order book volumes, these also showing large-volume traders reducing exposure.

“BTC ranging prices have a lot to do with declining whale interest,” research firm Santiment continued on the topic.

Another chart highlighted what Santiment said was a “correlation” between large transactions of $1 million or more and overall BTC price strength. Those transactions are now at their lowest levels since December 2020.

“If prices continue sliding and a spike occurs, this would be a historically bullish signal,” it added.

In its “Just

Read more on cointelegraph.com