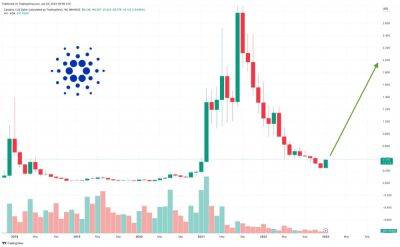

Price analysis 1/13: BTC, ETH, BNB, XRP, ADA, DOGE, MATIC, DOT, LTC, UNI

Bitcoin (BTC) rose above $19,000 on Jan. 12, the highest level since Nov. 8. Although a bull market may not start in a hurry, Glassnode data suggests that the foundation for a macro bottom in Bitcoin may be in place. The on-chain analytics firm tweeted on Jan. 12 that “13% of the Circulating Supply” returned to profit when Bitcoin rallied to $18,200. This suggests a large phase of accumulation took place in the $16,500 to $18,200 range.

Along with Bitcoin, Ether (ETH) is also witnessing signs of accumulation. The number of Ethereum sharks, holding between 100 and 10,000 Ether, has risen by 3,000 since November 22, according to Santiment data.

Many times, traders miss a bottom because they remain in denial. If traders want to catch a trend early, they should keep a close eye on the price action because a sequence of higher highs and higher lows may indicate a bullish sentiment.

Are Bitcoin and altcoins showing signs of starting a new uptrend? Let’s study the charts of the top-10 cryptocurrencies to find out.

Bitcoin is on the path of recovery. Strong buying by the bulls propelled the price above the stiff overhead resistance at $18,388 on Jan. 12. This is the first indication that the bears may be losing their grip.

The sharp rally of the past few days has pushed the relative strength index (RSI) into overbought territory, signaling a possible correction or consolidation in the near term.

If bulls do not allow the price to dip below the breakout level of $18,388, it will suggest a change in sentiment from selling on rallies to buying on dips. The BTC/USDT pair could then continue its recovery toward the next major resistance at $21,500.

If bears want to slow down the positive momentum, they will have to quickly pull the price

Read more on cointelegraph.com