Bitcoin Price and Ethereum Prediction: BTC Network's Mining Difficulty Rises to All-Time High

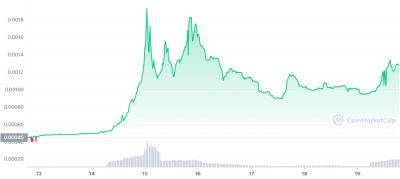

Bitcoin (BTC) and Ethereum (ETH), the world's two most popular digital currencies, maintained their lengthy upward trend and surpassed highs of $21,000 and $1,500, respectively. The mining difficulty of the Bitcoin network has recently reached an all-time high, making it more difficult for miners to make a profit.

This increase in difficulty could have an effect on the price of Bitcoin and Ethereum, as it could affect the profitability of mining these digital coins.

For the first time since the FTX crash of November 2020, the overall market value of all crypto assets has climbed to more than $1 trillion over the weekend. This is an impressive milestone and a good indication of how far digital currencies have come.

The cryptocurrency market has had an excellent year so far, with the value of most major coins increasing dramatically. Other digital currencies, such as Dogecoin (DOGE), Litecoin (LTC), and Ripple (XRP), are all performing well.

Although there have been reports of improving macroeconomic conditions, this might not be the only factor contributing to the increase in Bitcoin prices. However, the world's two most prominent digital currencies, Bitcoin (BTC) and Ethereum, were supported by the stock market's rise, lower inflation, and low-interest rates.

The Consumer Price Index (CPI) shows that inflation is declining, so the market expects the Federal Reserve's rate rise pace to slow down.

The fact that the US central banks have successfully reduced inflation while preventing the economy from entering a recession is clear evidence that bulls are back in the market. If macroeconomic conditions remain favorable, the current market momentum is expected to persist.

Additionally, the upcoming "Shanghai Hard Fork" for

Read more on cryptonews.com