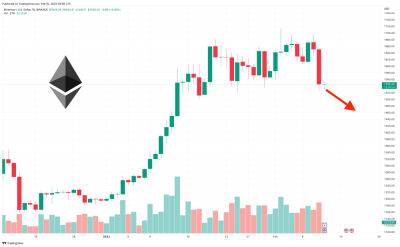

Bullish crypto traders maintain the upper hand despite the total market cap rejecting at $1T

The total crypto market capitalization soared by 29.4% in two weeks, although Bitcoin's (BTC) price stabilized near $21,000 on Jan. 19.

As a result, it became increasingly difficult to justify that the 5-month-long bearish trend still prevails after the $930 billion total crypto channel top has been breached. Still, the psychological $1 trillion resistance remains strong.

The move possibly reflects investors becoming more optimistic about risk assets after weaker than expected inflation metrics signaled that United States Federal Reserve interest rate hikes strategy should ease throughout 2023.

However, Klaas Knot, who serves as the governor of the Dutch central bank, stated on Jan. 19 that the European Central Bank (ECB) "will not stop after a single 50 basis point hike, that's for sure."

At the Davos forum Knot added: "core inflation has not yet turned the corner in the Euro area."

In essence, investors fear that another round of interest rate increases could further pressure corporate earnings, triggering unemployment and a deep recession. In this case, a sell-off on the stock market becomes the base scenario, and the crypto markets would likely follow the bear trend.

To further prove the strong correlation between cryptocurrencies and the stock markets, the Russell 2000 index faced a 3.4% decline between Jan. 18 and Jan. 19. The movement coincides with the total crypto market capitalization correcting by 4% after flirting with the $1 trillion mark on Jan. 18.

The 10.4% gain in total market capitalization between Jan. 12 and Jan. 19 was impacted mainly by Bitcoin's 10.4% gains and Ether (ETH), which traded up by 8.7%. The bullish sentiment was more eventful for altcoins, with 8 of the top 80 coins gaining 20% or more in the

Read more on cointelegraph.com