Berkshire earnings decline in the first quarter on slowing economic growth, stock market pullback

In this article

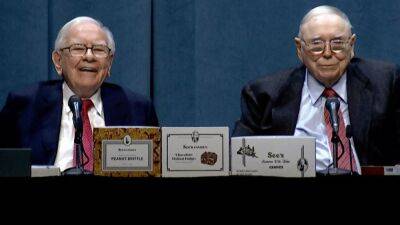

Warren Buffett's Berkshire Hathaway reported Saturday a decline in first-quarter earnings, as the conglomerate was not immune to a slowing U.S. economy.

The company's net earnings came in at $5.46 billion, down more than 53% from $11.71 billion in the year-earlier period.

Berkshire's operating earnings — which encompass profits made from the myriad of businesses owned by the conglomerate like insurance, railroads and utilities — were flat year over year at $7.04 billion. This comes amid a sharp drop in the company's insurance underwriting business; earnings from the segment dropped nearly 94% to $47 million from $764 million in the year-earlier period.

Earnings from Berkshire's manufacturing, service and retailing segment jumped 15.5% to $3.03 billion in the quarter, while railroad and utilities earnings increased slightly.

Those operating results came as the U.S. economy contracted in the first quarter for the first time since the onset of the Covid-19 pandemic.

The company also took a big hit from its investments, reporting a loss of $1.58 billion amid a broader market decline. To be sure, Buffett always advises shareholders to ignore these quarterly investment fluctuations.

«The amount of investment gains (losses) in any given quarter is usually meaningless and delivers figures for net earnings per share that can be extremely misleading to investors who have little or no knowledge of accounting rules,» Berkshire said in Saturday's release.

Berkshire's stock buybacks also slowed down to $3.2 billion from $6.9 billion in the fourth quarter of 2021, as the company was more active with dealmaking last quarter than it had been for a long time.

In late March, the company said it agreed to buy insurer

Read more on cnbc.com

![Did Litecoin’s [LTC] MWEB upgrade fail to woo investors - ambcrypto.com - city Santiment](https://finance-news.co/storage/thumbs_400/img/2022/5/28/27536_vhc.jpg)