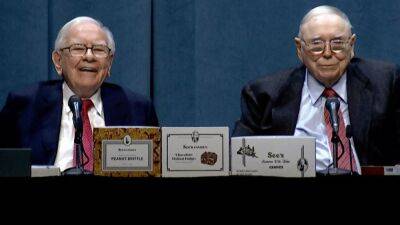

Bank stocks, once a Buffett favorite, take a back seat at Berkshire Hathaway amid recession worries

In this article

Warren Buffett has begun to unleash Berkshire Hathaway's massive cash stockpile in recent weeks, snapping up an insurer and multi-billion dollar stakes in energy and computer corporations.

But his recent moves are more notable for what he has avoided investing in — banks.

For years, big American banks were Warren Buffett's favorite investment. Like another top Buffett industry — railroads — banks are part of the infrastructure of the country, a nation he continually bets on. Banking is a business he understands, having helped rescue Salomon Brothers in the 1990s and injecting $5 billion into Goldman Sachs at the height of the 2008 financial crisis.

In fact, Buffett's top stock holding for three straight years through 2017 was Wells Fargo. As recently as late 2019, Berkshire had large stakes in four of the five biggest U.S. banks.

But something changed, and observers say it could have implications for the future of the U.S. economy. Investors and analysts are sure to ask Buffett about his views during the company's annual shareholder meeting on April 30.

(Watch the 2022 Berkshire Hathaway annual shareholders meeting live on Saturday, April 30 at 9:45 a.m. ET here: https://www.cnbc.com/brklive22/)

After Buffett began loading up on bank stocks in 2018, buying into JPMorgan Chase and Goldman as well as Bank of New York Mellon, PNC Financial and US Bancorp, he explained the moves to CNBC's Becky Quick as a classic value play, one of the hallmarks of his renowned investing career.

«They're very good investments at sensible prices, based on my thinking, and they're cheaper than other businesses that are also good businesses by some margin,» he said.

In particular, he was enthused about Jamie Dimon-led JPMorgan,

Read more on cnbc.com