Bank of England warns mortgage defaults to rise in months ahead

The number of mortgage defaults are expected to rise in the coming months, according to Bank of England data released on Thursday, while the number of new loans will continue to fall amid warnings that the “golden era” of cheap deals is ending.

The UK central bank’s latest quarterly credit conditions survey paints a gloomy picture, with the number of mortgage deals already falling before the chancellor’s mini-budget on 23 September.

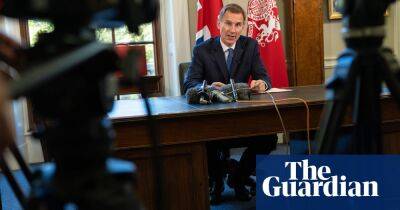

Kwasi Kwarteng’s package of unfunded tax cuts led to chaos for homebuyers, with hundreds of fixed-rate deals withdrawn over the space of a few days, before lenders returned with significantly more expensive deals.

Lenders surveyed by the Bank said the availability of secured credit to households, namely mortgages, declined in the three months to the end of August, and with further falls expected over the next three months to the end of November. The data, which was gathered before the mini-budget, found a similar picture for unsecured personal loans and credit card borrowing.

The availability of credit to businesses of all sizes was unchanged in the third quarter but was expected to worsen in the current quarter.

Mortgage rates have shot up: the average two-year fixed mortgage hit 6.46% this week, the highest since the financial crisis in 2008, while the average five-year deal was 6.32%, according to Moneyfacts.

“We are at the end of the golden age for cheap mortgages and with further interest rate rises seemingly around the corner, homeownership is set to become more costly for many of those on the property ladder and those reaching for the first rung,” said Myron Jobson, a senior personal finance analyst at the investment platform interactive investor.

Samuel Tombs, the chief UK economist at

Read more on theguardian.com