XRP Price Prediction As Brad Garlinghouse Comments on SEC vs Ripple Case - Lawsuit Judgement Soon

As the Ripple vs. SEC lawsuit edges closer to a resolution, the crypto industry is watching with bated breath, as traders lean short - could there be turbulent times ahead for XRP price prediction?

The lawsuit's outcome holds tremendous potential to shape the regulatory landscape in the United States, an arena currently lacking a cohesive framework for governing the sector.

A key development came when Judge Torres rejected the SEC's plea to keep the Hinman documents confidential, paving the way for public access.

With an anticipated disclosure date of 13th June 2023, this development might tilt the balance in Ripple's favor.

However, traders are displaying caution amidst these developments - short positions against XRP have risen, indicating a more sceptical sentiment within the trading community.

Despite this, Ripple has been forging ahead with ambitious projects - they're partnering with Hong Kong's e-HKD Pilot Programme to explore real estate tokenization, and they're collaborating with over 20 countries to develop Central Bank Digital Currencies (CBDCs).

Ripple CEO Brad Garlinghouse expects a court decision on the SEC lawsuit "in weeks, not months."

His optimism, coupled with recent developments, suggests that Ripple might be on the verge of a significant breakthrough.

As we delve into the price analysis, these developments will be crucial in shaping XRP's trajectory and the broader crypto market.

As markets brace for the rapidly approaching SEC v. Ripple judgement, XRP's technical structure remains poised for a huge break up in the event of a positive disclose on June 13.

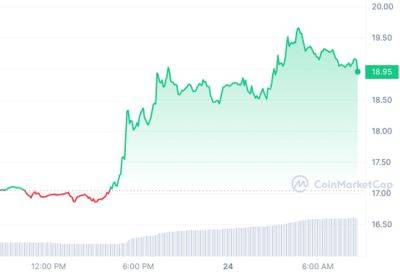

With XRP currently trading at $0.46 (representing a 24 hour change of +2.18%), 9 days of consolidation seems to be holding strong.

The ongoing price level

Read more on cryptonews.com