Why is sterling falling and what does it mean for the rest of the world?

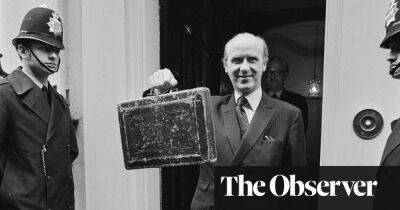

The pound has hit a record low against the dollar after the UK government announced sweeping tax cuts in a mini-budget last Friday. So why is sterling falling so steeply, and what does that mean for the rest of the world?

When foreign exchange markets turn against a country, the value of that country’s currency begins to plummet. For instance, Turkey’s currency is worth about 40% less against the US dollar than last year after traders were spooked by a rise in annual inflation to more than 70%.

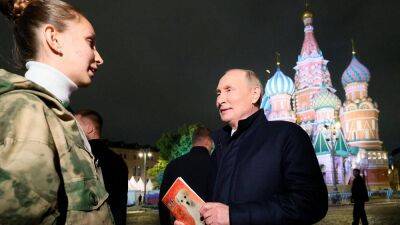

The British pound has slumped in recent weeks as markets have become disenchanted with the new administration under the newly appointed prime minister, Liz Truss. She signalled an expansive economic policy based on wide-ranging tax cuts.

Her chief finance minister, or chancellor, Kwasi Kwarteng, has been accused of ignoring a 9.9% inflation rate that economists said was only going to worsen, instead choosing in Friday morning’s mini-budget to pump lots more money into the economy. Currency traders have given their verdict over the weekend and Monday, sending the pound from almost $1.20 to a record low of $1.03 before a partial recovery to $1.06.

A sudden and sharp drop in sterling creates uncertainty, throwing the plans of UK businesses that import and export goods into disarray. They expect to pay a specific sum for imports and get a certain price for goods and services they sell abroad. All that changes when the currency falls. If the pound is worth less, the cost of importing goods from overseas goes up.

A weaker pound means price rises for UK consumers who buy foreign goods, and it means their money won’t go as far if they travel to the US or countries that use the US dollar.

Oil is one of the key goods Britain imports and it is

Read more on theguardian.com