Why is Bitcoin price down today?

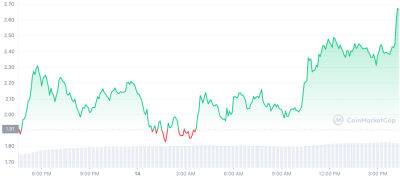

After topping the $21,500 mark on Nov. 4, Bitcoin (BTC) price is down by 14% on Nov. 8, reaching a new yearly low at $17,166 and most altcoins are following suit.

While the Binance and FTX news initially caused an uptick in the market, the day turned south as various unconfirmed sources speculate that FTX’s losses could show a $6 billion deficit.

This price decline breaks Bitcoin’s short-term correlation to the stock market, with the tech-heavy Nasdaq down only 0.32%, while the Dow Jones gained 0.48% on the back of investors’ optimism about the Nov. 8 U.S. Midterm elections.

In the backdrop of the current volatility, $614 million in BTC longs are at risk of liquidation with over $224 million liquidated on Nov. 8. The fear for many is if the FTX situation is not resolved by Binance’s bid to purchase the exchange, a sharper sell-off in the market could trigger a liquidation cascade and send BTC price to new lows.

Let’s investigate the main reasons why the Bitcoin price is down today.

Bitcoin price is reacting to the stress placed on the market by the FTX, reaching a yearly low after a period where many thought the bear market bottom had been found.

The May 2022, Terra Luna implosion and ultimate collapse of LUNA Classic produced the first 7-week losing streak in Bitcoin’s history. The market is drawing parallels between the current FTX bank run, the perceived large budget hole and what happened to Terra Luna earlier this year.

Based on the Consumer Price Index Report, inflation in the United States increased by 0.6% in September compared to the previous month.

The Consumer Price Index report - the most widely followed barometer of inflationary pressure in the United States - climbed 8.2% in September compared to the same

Read more on cointelegraph.com