Why do crypto projects have such a high failure rate after launchpads? | Find out in our live AMA

Bear markets are a good time to reflect — and a question that isn't asked often enough is this: Why do crypto projects have such a high failure rate… and how can they scale to boost their chances of success?

That's a topic we're going to dive into during Cointelegraph's latest ask-me-anything session on YouTube, where we'll be joined by Qonetum Finance.

CEO and CTO Yoda Regev will be with our very own Rachel Wolfson to discuss the challenges facing fledgling projects that are trying to get off the ground.

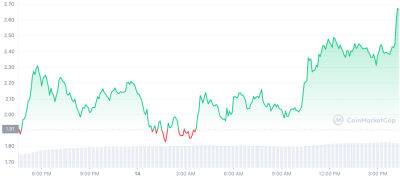

While CoinMarketCap data shows that thousands of token projects have completed seed funding or a token offering, Yoda argues that the big challenge comes when they need to raise further capital and liquidity — a crucial step in order to scale.

It is worth noting that this isn't just a crypto-specific problem — and according to this entrepreneur, 98% of startups fail because of this.

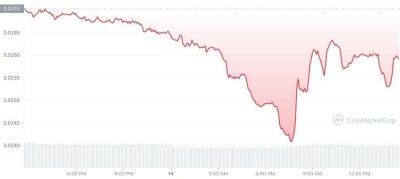

Typically in the crypto ecosystem, projects have tokens that can be sold to generate capital — but they need to tread carefully. Offering discounts under current market prices can lead to tokens being dumped, crashing valuations in a sudden and spectacular way.

Yoda argues that bear markets exacerbate these risks even further — and any attempt to withdraw liquidity from pools ends up being regarded as a rug pull, sparking fresh panic. Projects wanting to scale need safe and fresh solutions following a launchpad's initial fundraising.

Qonetum Finance's solution is a new ScalePad approach called a Post DEX Offering based on quantum finance models — and the leader of this DeFi ecosystem will explain this concept in depth during the livestream.

Yoda will offer an insight into how a hybrid of fundraising, strategic staking and liquidity mining can

Read more on cointelegraph.com